When it comes to "nursing home medications", understanding the coverage options available is crucial for both residents and their families. As individuals transition into long-term care facilities, questions often arise regarding the continuation of their current prescription plans or if alternative programs might provide better support. This article aims to explore the factors that influence medication coverage in nursing homes and what families should consider when making these important decisions.

Understanding Nursing Home Medications

Nursing home medications refer to the prescriptions provided to residents of assisted living facilities, skilled nursing homes, or other long-term care establishments. These medications are essential for managing chronic conditions, alleviating symptoms, and ensuring the overall well-being of residents. The cost of these medications can be significant, and understanding how they are covered is vital for financial planning.

Current Coverage Options

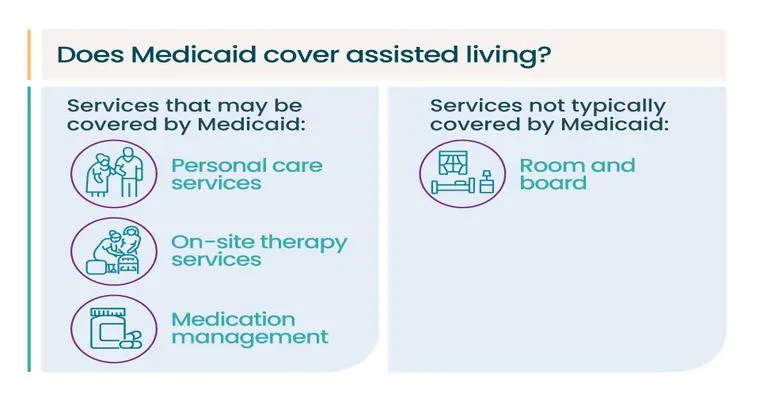

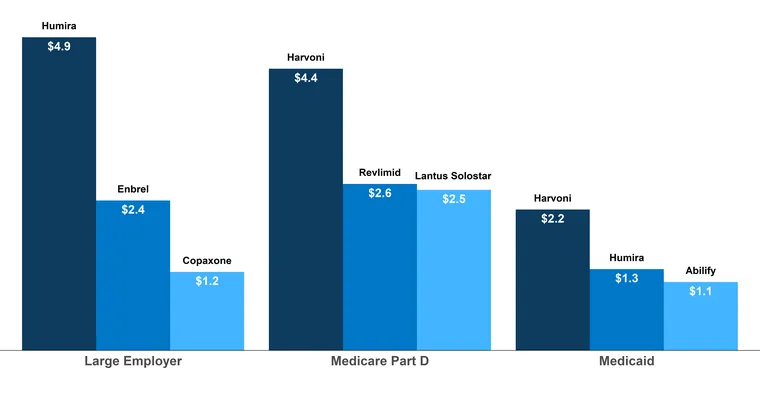

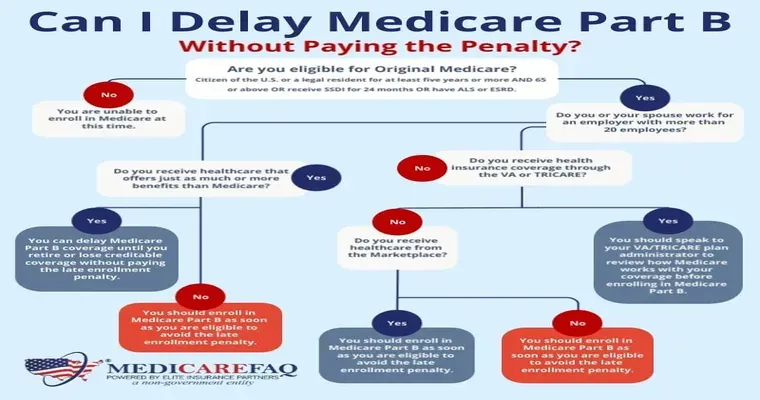

Most nursing home residents rely on Medicare, Medicaid, or private insurance plans to cover their medications. Medicare Part D is a common choice, as it helps cover the costs of prescription drugs for eligible individuals. However, coverage specifics can vary widely based on the plan selected. Families must review whether their current coverage adequately addresses the "medication needs" of their loved ones.

Evaluating Alternative Programs

As families consider whether to continue with their current coverage, it is important to explore other potential programs. Some nursing homes have partnerships with pharmaceutical companies or discount programs that might offer more affordable medication options. Additionally, state programs may provide assistance for low-income residents who require extensive medical care.

Factors Influencing Coverage Decisions

Several factors can influence whether to maintain current medication coverage or switch to a different program:

1. "Cost": Analyzing the overall cost of medications under the current plan versus alternative options is essential. It is important to consider out-of-pocket expenses, deductibles, and co-pays.

2. "Medication Needs": The specific medications required for the resident's health condition can impact coverage. Some programs may not cover certain drugs, while others may have more comprehensive lists.

3. "Provider Recommendations": Consulting with healthcare providers or pharmacists can provide valuable insights into which coverage options best meet the resident's medication requirements.

4. "Eligibility Changes": Life changes, such as a change in income or health status, may affect eligibility for various programs and should be taken into account.

Conclusion

Deciding whether to continue "nursing home medication" coverage or explore alternative programs is a significant decision that requires careful consideration. Families should evaluate current options, assess their loved one's specific needs, and stay informed about any changes that might affect medication coverage. By doing so, they can ensure that their family member receives the necessary medications without incurring undue financial strain. As healthcare landscapes evolve, staying proactive about medication coverage will ultimately lead to better outcomes for nursing home residents.