Navigating the complexities of "Medicaid" can be a daunting task, especially when it comes to "spending down" assets to qualify for benefits. As a caregiver for my elderly parent, I found myself facing the challenges of managing finances while ensuring the best possible care. This personal journey through the "Medicaid spending down" process has taught me invaluable lessons about both the system and the importance of planning ahead.

When my parent was diagnosed with a chronic illness, I quickly realized that our financial situation would impact their eligibility for "Medicaid benefits". The term "spending down" refers to the process of reducing one’s assets to meet the financial criteria set by Medicaid. For many families, this can feel like a stressful and complicated task, but with the right knowledge and support, it can be navigated successfully.

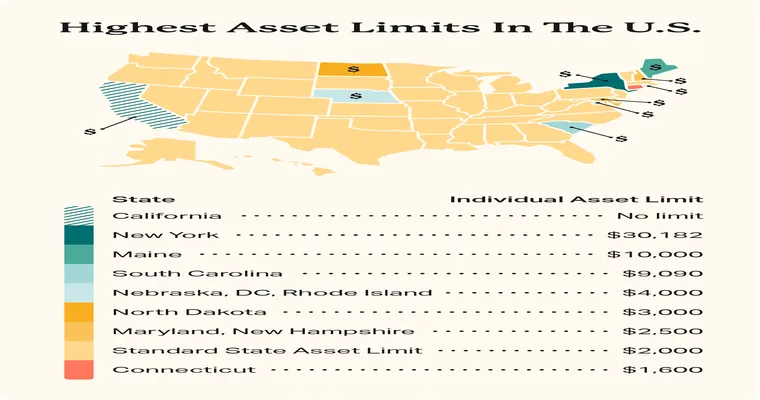

The first step in our journey was to assess my parent's current financial status. This involved listing all assets, including bank accounts, properties, and investments. Medicaid has strict asset limits that vary by state, so understanding these limits was crucial. In our case, the "Medicaid eligibility" threshold was quite low, making it necessary to devise a plan for spending down excess assets.

One of the most effective strategies I discovered was to pay off debts. By clearing outstanding loans and credit card bills, I could reduce my parent's overall asset value while simultaneously improving their financial health. Additionally, I made sure to keep essential expenses up to date, such as home repairs and medical bills, which can also be counted towards the spending down process.

Another significant aspect of the spending down strategy was gifting assets to family members. However, I quickly learned that there are specific rules regarding "asset transfer" that must be adhered to in order to avoid penalties. For instance, Medicaid has a look-back period, typically five years, during which any gifts made may affect eligibility. Therefore, I carefully documented all transactions and consulted with a financial advisor to ensure compliance.

Investing in my parent's care also proved to be a wise choice. Using some of the excess funds to pay for home modifications or additional medical services not only improved my parent’s quality of life but also aligned with Medicaid's regulations. This proactive approach allowed us to utilize funds in a meaningful way while preparing for the Medicaid application.

Throughout this journey, I found that communication was key. I reached out to other caregivers and local advocacy groups for support and guidance. Many shared their own stories of navigating the Medicaid system, which provided me with insights and encouragement. Understanding that I was not alone in this experience was incredibly comforting.

As we approached the application process, I worked diligently to gather all necessary documentation, including financial statements, medical records, and proof of expenditures related to the spending down strategy. This meticulous preparation helped ensure a smoother application experience.

Ultimately, my journey through the Medicaid spending down process taught me the importance of planning, communication, and resourcefulness. While the road can be challenging, with the right strategies and support, it is possible to navigate the complexities of Medicaid and secure the care our loved ones need.

In conclusion, spending down for Medicaid does not have to be a daunting task. By understanding the process, exploring various strategies, and seeking support from others, caregivers can successfully manage their loved ones' finances and ensure they receive the necessary care. My personal journey has reinforced the idea that with knowledge and preparation, we can turn challenges into opportunities for better care and support.