Navigating the complexities of "Medicaid" eligibility can be daunting, leading some individuals to consider "hiding money" to qualify for benefits. However, this approach can have serious consequences. Understanding the implications of attempting to conceal assets is crucial for anyone seeking assistance from this vital healthcare program.

Medicaid is designed to provide health coverage for low-income individuals, including the elderly, disabled, and families in need. To qualify, applicants must meet specific income and asset limits. Because of this, some people may be tempted to hide their financial resources to gain eligibility. However, this practice is not only unethical but also illegal.

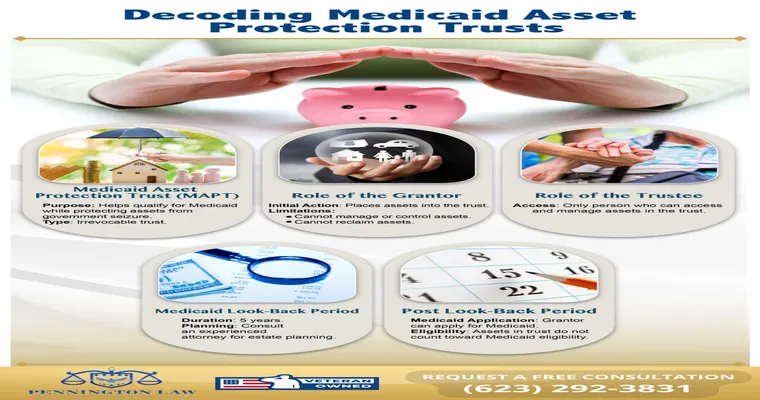

One of the primary risks of hiding money from Medicaid is the potential for "penalties". If a state discovers that an applicant has attempted to conceal assets, this can lead to a denial of benefits for a significant period. In many states, the look-back period for asset transfers is five years. If assets are discovered that were hidden or improperly transferred during this time, applicants may face a penalty period during which they will not receive coverage.

Additionally, Medicaid employs various methods to verify financial information. States can conduct audits and investigations to ensure compliance with eligibility requirements. Those found guilty of attempting to hide assets may also face legal consequences, including fines or even criminal charges in severe cases.

It's important to consider the ethical implications of hiding money from Medicaid. The program is funded by taxpayers and is intended to support those who genuinely need assistance. By attempting to manipulate the system, individuals are undermining the very purpose of Medicaid, potentially depriving others of essential services.

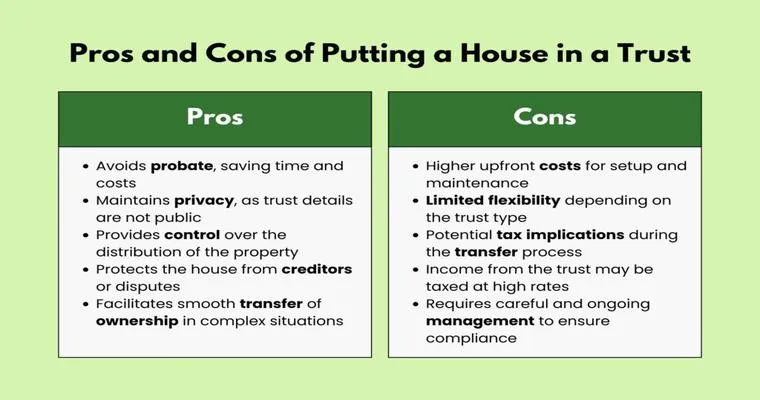

Instead of considering dishonest tactics, individuals should explore legitimate ways to prepare for Medicaid eligibility. This can include "financial planning", consulting with elder law attorneys, or utilizing trusts and other financial instruments that comply with Medicaid regulations. These strategies can help individuals protect their assets while remaining within the bounds of the law.

In conclusion, while the temptation to hide money from Medicaid may seem appealing to some, the risks and repercussions far outweigh any potential benefits. Embracing transparency and seeking professional guidance on Medicaid eligibility will not only safeguard individuals from penalties but also ensure that they are adhering to the principles of fairness and integrity in the healthcare system.