When planning for long-term care and "Medicaid" eligibility, many individuals seek effective strategies to safeguard their most valuable asset: their home. One popular method is establishing a "life estate", which allows homeowners to retain certain rights while protecting their property from being counted as an asset for Medicaid purposes. Understanding how a life estate works is crucial for anyone looking to plan for potential nursing home care or other long-term health services.

A "life estate" is a legal arrangement where one person, known as the "life tenant," retains the right to live in and use the property for the duration of their life, while another person, the "remainder beneficiary," holds the future interest in the property. This means that when the life tenant passes away, the property automatically transfers to the remainder beneficiary without going through probate. By creating a life estate, homeowners can effectively transfer the ownership of their home while still enjoying the right to use it during their lifetime.

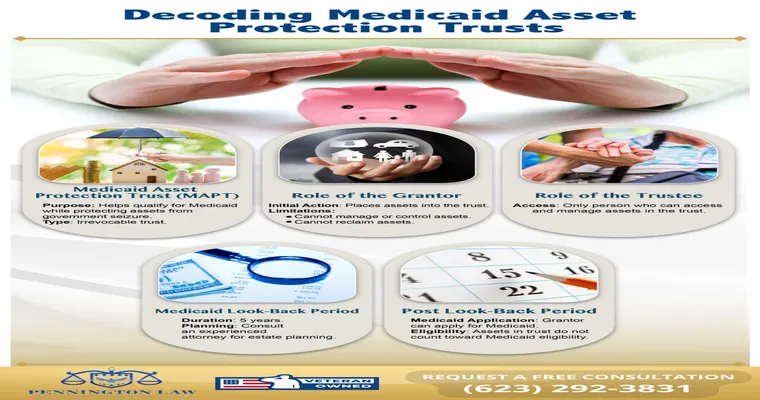

One of the primary advantages of using a life estate in the context of "Medicaid planning" is asset protection. When applying for Medicaid, an individual's assets are assessed to determine eligibility for benefits. By establishing a life estate, the home is no longer considered a countable asset for Medicaid purposes, provided that the transfer is made more than five years before applying for benefits. This five-year "look-back" period is crucial, as any transfers made within this timeframe may incur penalties and affect eligibility.

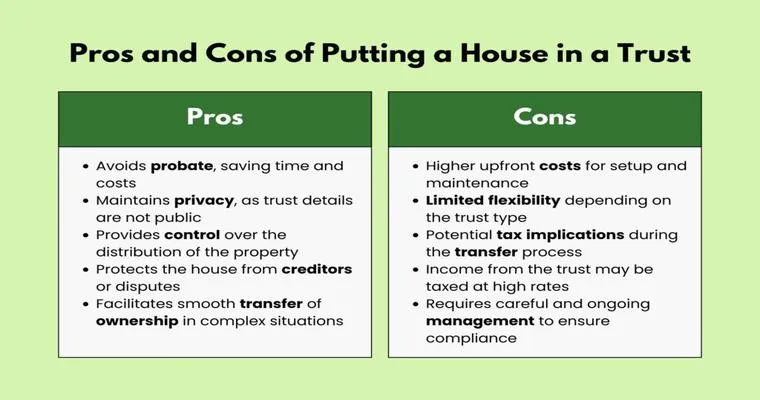

However, it's important to understand the implications of a life estate. While the life tenant maintains the right to live in the home, they also assume responsibility for property taxes, maintenance, and repairs. Additionally, if the life tenant requires long-term care in the future, the home may still be subject to claims from creditors or from the state for reimbursement of Medicaid benefits paid on their behalf. Therefore, careful planning and consultation with a qualified attorney specializing in elder law or estate planning is recommended to navigate these complexities.

Another consideration is the potential impact on estate taxes and inheritance. When a home is transferred via a life estate, the property retains its original cost basis, which means that any appreciation in value may be subject to capital gains taxes upon sale. This can create financial burdens for the remainder beneficiaries if they decide to sell the property after the life tenant's death.

In conclusion, using a "life estate" is a viable strategy for "protecting the home from Medicaid" while allowing homeowners to retain their rights for life. It’s essential to weigh the benefits against the potential drawbacks and seek professional guidance to ensure that the arrangement aligns with overall estate planning goals. By understanding how a life estate works, individuals can make informed decisions about preserving their assets and securing their financial future in the face of long-term care needs.