As the cost of healthcare continues to rise, many individuals are becoming increasingly concerned about how "Medicaid" can impact their financial security. Protecting your "assets" from Medicaid's reach is essential for ensuring that you have enough funds for your future needs. In this article, we will explore the top five strategies for safeguarding your money from Medicaid while still ensuring you receive the care you may need.

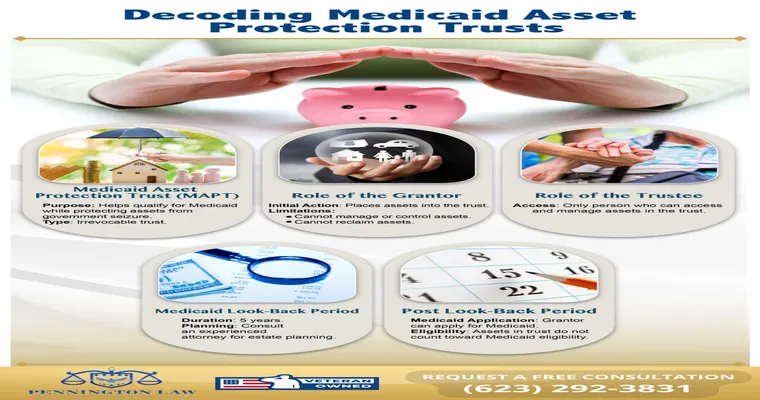

One of the most effective ways to protect your assets is through "asset transfer". This involves gifting or transferring ownership of certain properties or funds to family members or loved ones. However, it is crucial to be aware of the "look-back period"—a timeframe during which Medicaid will review your financial transactions. Typically, this period is five years, so it is advisable to start planning early to avoid penalties.

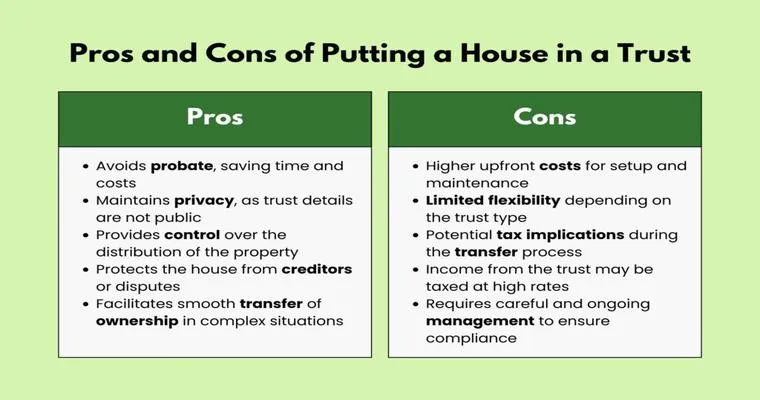

Another strategy is to set up a "trust". A properly structured trust can help protect your assets from being counted against you when applying for Medicaid benefits. There are various types of trusts, such as irrevocable trusts, which can keep your assets safe while still allowing you to qualify for Medicaid. Consulting with an estate planning attorney can help you determine the best type of trust for your specific situation.

Repositioning your "assets" can also be an effective strategy. This approach involves converting liquid assets into non-countable assets. For instance, purchasing a primary residence or investing in a funeral trust can help shield your money from Medicaid eligibility assessments. However, it's essential to ensure that these investments comply with Medicaid regulations to avoid complications.

Creating a "Medicaid-compliant annuity" is another way to protect your money. These financial products convert a lump sum of money into a stream of income, which can be beneficial for Medicaid eligibility. A Medicaid-compliant annuity must meet specific criteria, so working with a financial advisor who understands Medicaid rules is crucial to ensure that you are making the right decisions.

Finally, consider engaging in "long-term care insurance". This type of insurance can provide coverage for nursing home care or in-home care, allowing you to preserve your assets while still receiving necessary medical assistance. By investing in long-term care insurance, you can mitigate the risk of depleting your savings due to unexpected healthcare expenses.

In conclusion, protecting your money from Medicaid requires careful planning and an understanding of various strategies. By utilizing asset transfers, establishing trusts, repositioning assets, creating Medicaid-compliant annuities, and considering long-term care insurance, you can safeguard your financial future while ensuring you receive the care you need. Always consult with professionals who specialize in elder law or financial planning to tailor these strategies to your unique situation and needs.