Medicaid planning is an essential process for individuals seeking to secure long-term care while preserving their assets. However, many people make critical "Medicaid planning mistakes" that can jeopardize their eligibility and financial well-being. Understanding these common pitfalls can help you navigate the complexities of Medicaid and ensure that you make informed decisions. Here are the top eight "Medicaid planning mistakes" to avoid.

1. "Waiting Until the Last Minute"

One of the most significant mistakes individuals make is waiting until a health crisis occurs to start their "Medicaid planning". Procrastination can lead to rushed decisions and missed opportunities to protect assets. It is essential to begin planning well in advance, ideally several years before a need for long-term care arises. This proactive approach allows for a more strategic and informed planning process.

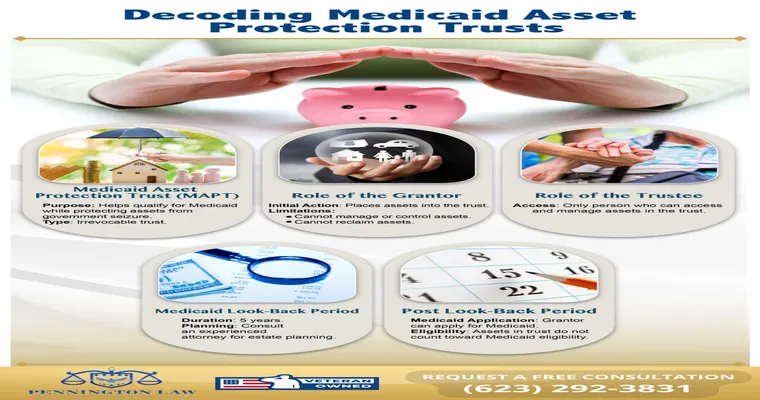

2. "Not Understanding the Look-Back Period"

A common misconception about "Medicaid eligibility" is that transferring assets just before applying can help you qualify. However, Medicaid has a "look-back period" of five years, during which any asset transfers may be scrutinized. Failing to understand this timeframe can result in penalties that delay your eligibility, making it crucial to plan asset transfers well in advance.

3. "Ignoring State-Specific Rules"

Medicaid is a joint federal and state program, which means that each state has its own rules and regulations governing eligibility and benefits. Many people mistakenly assume that the rules are the same everywhere. Ignoring state-specific rules can lead to misunderstandings about what assets are exempt and how income is calculated. It is vital to consult with a professional familiar with your state's "Medicaid planning" requirements.

4. "Failing to Seek Professional Guidance"

Navigating the "Medicaid application process" can be complex and overwhelming. Many individuals try to handle their planning without professional help, which can lead to errors and misunderstandings. Seeking guidance from an experienced elder law attorney or financial planner specializing in "Medicaid planning" can provide valuable insights and help you avoid costly mistakes.

5. "Not Considering Spousal Protections"

For married couples, it is essential to understand the protections available for the spouse who will not require long-term care. Many people overlook the importance of "spousal eligibility rules", which can allow the non-applicant spouse to retain a certain amount of assets and income. Failing to consider these protections can result in unnecessary financial strain.

6. "Mismanaging Assets"

Some individuals attempt to hide or give away assets to qualify for "Medicaid", believing this will not be discovered. However, engaging in asset mismanagement can lead to severe penalties and disqualification from benefits. It is crucial to follow legal avenues for asset protection and to be transparent about your financial situation during the application process.

7. "Overlooking Healthcare Needs"

Many people focus solely on financial aspects when planning for "Medicaid", neglecting the importance of healthcare needs. It is vital to consider the type and level of care required, as well as any specific medical conditions that may impact eligibility. Failing to address these needs can lead to inadequate care and financial difficulties down the line.

8. "Neglecting to Update Plans"

Finally, one of the most overlooked mistakes in "Medicaid planning" is failing to regularly review and update your plans. Life changes, such as the birth of a child, changes in income, or shifts in health status, can all impact your "Medicaid eligibility". It is essential to regularly assess and adjust your planning strategy to reflect your current situation.

In conclusion, avoiding these common "Medicaid planning mistakes" can significantly enhance your financial security and ensure that you receive the care you need. By starting early, seeking professional advice, and staying informed about your state's rules, you can navigate the complexities of Medicaid with confidence.