When considering estate planning options, many individuals and families explore the benefits of a "living trust". A "living trust" is a legal document that allows you to manage your assets during your lifetime and specifies how those assets should be distributed after your death. While there are significant advantages to establishing a "living trust", there are also some drawbacks that should be carefully evaluated. In this article, we will examine the "pros and cons" of a "living trust" to help you make an informed decision.

Pros of a Living Trust

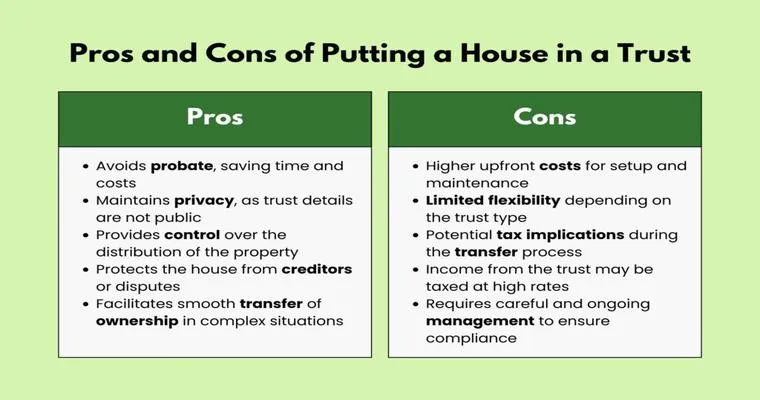

One of the most compelling advantages of a "living trust" is the avoidance of probate. When a person passes away, their estate typically goes through the probate process, which can be lengthy and costly. With a "living trust", assets can be transferred directly to beneficiaries without the need for probate, thus saving time and money. This can be especially beneficial for families who want to minimize the stress associated with settling an estate.

Another significant benefit is the ability to maintain privacy. Unlike a will, which becomes a public document during the probate process, a "living trust" remains private. This means that the details of your estate and your beneficiaries are not disclosed to the public, allowing for greater confidentiality regarding your financial affairs.

Additionally, a "living trust" can provide flexibility in managing your assets. You can specify how and when your beneficiaries receive their inheritance, which can be particularly useful for minor children or individuals who may not be financially responsible. This allows you to tailor your estate distribution to meet the unique needs of your family members.

Cons of a Living Trust

Despite the advantages, there are also some disadvantages to consider when creating a "living trust". One of the primary downsides is the initial cost and complexity involved in setting one up. Establishing a "living trust" typically requires legal assistance, which can lead to higher upfront costs compared to simply drafting a will. Additionally, funding the trust—transferring ownership of assets into the trust—can be time-consuming and may require ongoing management.

Another potential drawback is the limited protection against certain legal claims. While a "living trust" can shield assets from probate, it does not necessarily protect them from creditors or lawsuits. If you are concerned about potential legal issues, a "living trust" may not provide the level of protection you desire.

Lastly, a "living trust" does not address issues related to incapacity. If you become unable to manage your financial affairs, a "living trust" does not automatically appoint someone to handle your assets unless you have included specific provisions for that scenario. This could leave your estate vulnerable during your period of incapacity.

Conclusion

In conclusion, a "living trust" can offer significant benefits, including probate avoidance, privacy, and flexible asset management. However, it also comes with certain challenges, such as setup costs, complexity, and limited legal protections. Ultimately, the decision to create a "living trust" should be based on your individual circumstances and estate planning goals. Consulting with an experienced estate planning attorney can provide valuable insights and help you determine whether a "living trust" is the right choice for you and your loved ones.