Preparing for "Medicaid" while ensuring that you and your wife can still access your long-saved-for "nest egg" is a crucial step for many couples approaching retirement age or facing health issues. Understanding the complexities of Medicaid and financial planning can help you protect your assets while still qualifying for this vital program. Here’s a comprehensive guide to help you navigate this process effectively.

Understanding Medicaid Eligibility

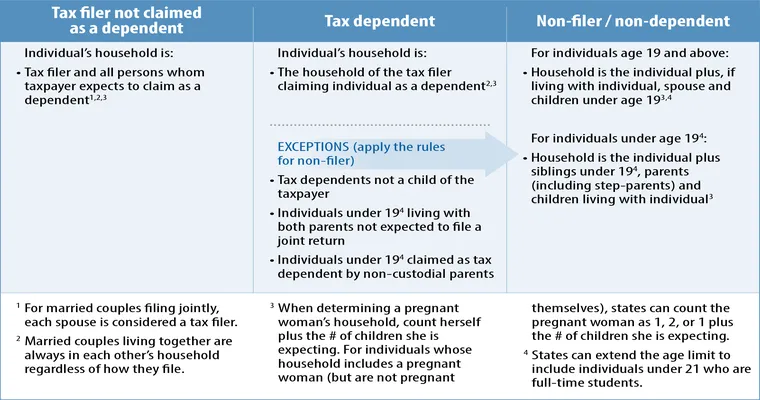

Before diving into asset protection, it is essential to understand how "Medicaid eligibility" works. Medicaid is a state and federal program designed to assist low-income individuals with medical costs. Each state has its own regulations regarding income and asset limits, which can vary significantly. Generally, for a couple, the combined countable assets must be below a certain threshold to qualify for benefits.

Assessing Your Financial Situation

Start by conducting a thorough assessment of your financial situation. List all your assets, including bank accounts, investments, property, and retirement accounts. Identify what is considered countable versus non-countable assets according to Medicaid rules. In many states, certain assets such as your primary home, a vehicle, and some personal items may not count against the eligibility limit.

Creating an Asset Protection Strategy

To retain access to your nest egg while preparing for Medicaid, consider these strategies:

1. "Spend Down Excess Assets": If your assets exceed the Medicaid limit, consider spending down on items that improve your quality of life, such as home renovations, paying off debts, or purchasing necessary medical equipment.

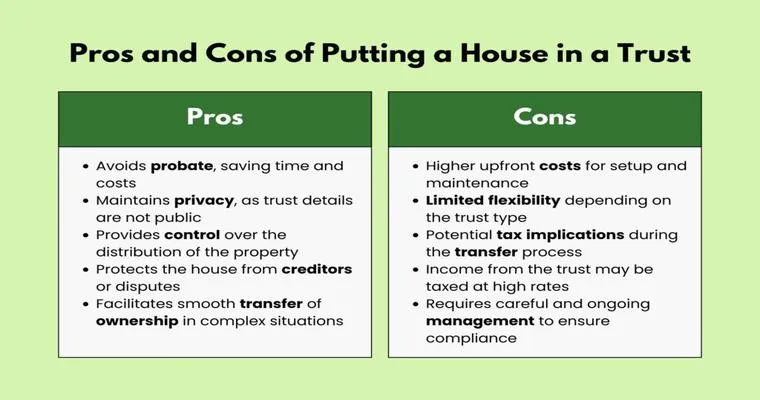

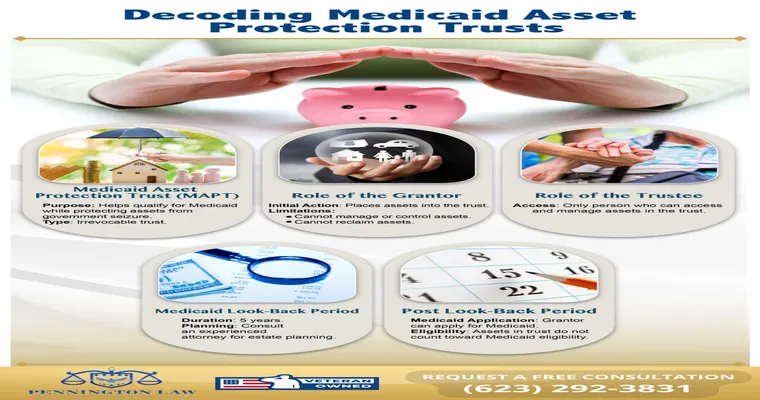

2. "Establish a Trust": A "Medicaid Asset Protection Trust" can be an effective way to shelter assets from Medicaid's reach. By placing your assets in a trust, they may not be counted towards your eligibility. However, it’s crucial to establish this trust well in advance of applying for Medicaid, as there are look-back periods that could affect eligibility.

3. "Gifting": Consider gifting assets to your children or other family members. However, be cautious with this approach, as Medicaid has a five-year look-back period. If you gift assets within this timeframe, it could affect your eligibility.

4. "Purchase Exempt Assets": Invest in exempt assets that do not count against Medicaid limits, such as a new home or certain types of annuities. Ensure these purchases align with Medicaid regulations.

5. "Consult with a Professional": Engaging with a financial advisor or an elder law attorney who specializes in Medicaid planning can provide tailored strategies to protect your assets effectively. They can help navigate state-specific rules and ensure compliance while maximizing your benefits.

Planning for Healthcare Needs

As you prepare for Medicaid, consider your and your wife’s potential healthcare needs. Understanding the services covered by Medicaid, such as long-term care and home health services, will help you plan appropriately. Ensure that you have all necessary documentation ready, including medical records and financial statements, to streamline the application process.

Final Thoughts

Preparing for Medicaid while safeguarding your nest egg requires careful planning and informed decision-making. By understanding Medicaid eligibility, assessing your financial situation, and implementing asset protection strategies, you can ensure that you and your wife have access to your hard-earned savings while receiving the healthcare support you need. Remember, starting this process early and consulting with professionals can make a significant difference in achieving both goals.