Navigating "Medicaid" and its policies can be particularly challenging for families dealing with the complexities of "memory care facilities" and the implications of long-term care on "homeownership". A common concern arises when one spouse is receiving Medicaid benefits while residing in a memory care facility, and the other spouse continues to live in the family home. Many families wonder whether Medicaid can place a "lien" on the home to recover costs upon the death of the spouse receiving care.

To understand the implications of Medicaid liens, it is essential to grasp how Medicaid works, particularly regarding the treatment of assets and property. Medicaid is a government program designed to assist low-income individuals with healthcare costs, including long-term care services. When one spouse enters a memory care facility and qualifies for Medicaid, the program may seek reimbursement for the expenses incurred during their care. However, specific rules govern how and when Medicaid can claim assets, especially when one spouse remains in the home.

In many states, if one spouse is receiving Medicaid while the other spouse continues to live in their shared home, Medicaid typically cannot place a lien on that property. This is primarily due to the concept of "spousal resource protection", which ensures that the well spouse can maintain a reasonable standard of living without being forced to sell the home. In these cases, the home is often considered an exempt asset, meaning it is not counted against the Medicaid eligibility criteria for the spouse in the facility.

However, once the spouse receiving care passes away, the situation can change. Medicaid may pursue a lien on the home to recover the costs associated with the care provided to the deceased spouse. This process is known as "Medicaid estate recovery". It is crucial for families to be proactive in understanding their options and rights when it comes to Medicaid and estate planning.

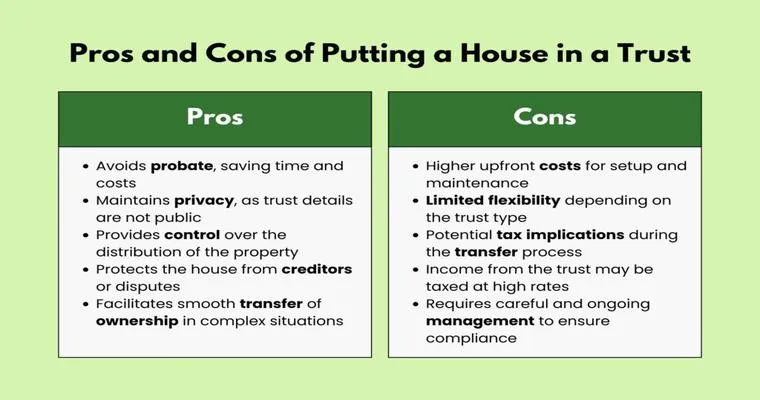

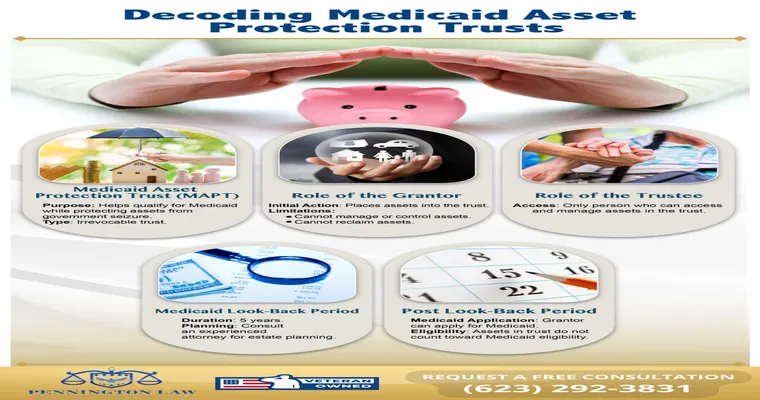

There are several strategies that families can employ to protect their home from potential liens. One of the most effective methods is to consult with an attorney who specializes in "Elder Law" or Medicaid planning. They can provide guidance on how to structure ownership of the home, possibly through the use of trusts or other legal instruments, to safeguard it from Medicaid claims after the passing of the spouse in care.

Additionally, it is essential for families to be aware of the specifics of their state’s Medicaid program, as rules and regulations can vary significantly. Some states have more lenient policies regarding home exemptions, while others may have stricter guidelines that could lead to a lien being placed on the property after the death of the spouse.

In conclusion, while Medicaid has the authority to place a lien on a home to recover costs after the death of a spouse in a memory care facility, there are protections in place for the spouse who continues to live in the home. Understanding these protections and seeking appropriate legal advice can help families navigate the complexities of Medicaid and ensure that their home is safeguarded for the surviving spouse. By being informed and proactive, families can make more strategic decisions regarding their care and estate planning needs, ultimately preserving their assets for future generations.