When it comes to estate planning, understanding the differences between a "life estate" and a "Lady Bird deed" is crucial for ensuring that your assets are handled according to your wishes. Additionally, taking steps to prevent the sale of property via "power of attorney (POA)" is an important consideration for many individuals. This article will explore these concepts and provide suggestions for effective estate planning.

Understanding Life Estates

A "life estate" is a legal arrangement in which an individual (the life tenant) retains the right to live in and use a property for the duration of their life. Upon their death, the property automatically transfers to the designated beneficiaries, known as remaindermen. This arrangement can provide benefits such as avoiding probate and ensuring that the property is passed on to heirs without interference.

However, life estates come with certain limitations. The life tenant cannot sell or mortgage the property without the consent of the remaindermen. This can lead to complications if the life tenant needs to access funds or wishes to make changes to the property.

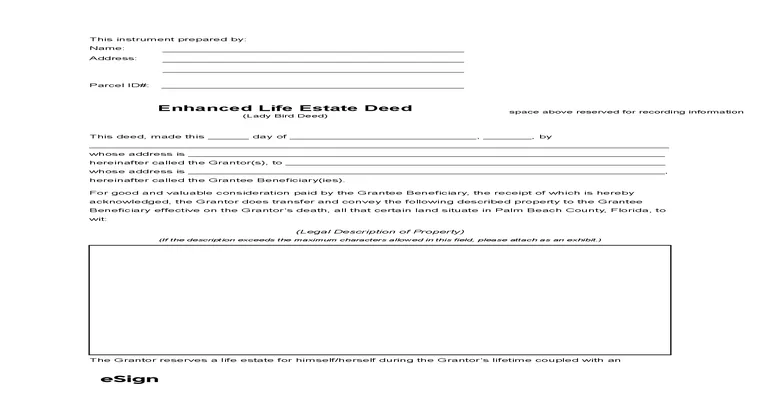

Exploring Lady Bird Deeds

A "Lady Bird deed", also known as an enhanced life estate deed, offers a more flexible option than a traditional life estate. With this type of deed, the property owner retains the right to live in and control the property during their lifetime, similar to a life estate. However, unlike a traditional life estate, the property owner can sell, lease, or mortgage the property without the need for consent from any beneficiaries.

One of the main advantages of a Lady Bird deed is that it allows the property owner to avoid probate while also retaining full control over their property. Upon the owner's death, the property automatically transfers to the designated beneficiaries, making it an effective tool for estate planning.

Preventing Sale via Power of Attorney

A "power of attorney" (POA) is a legal document that grants someone the authority to act on behalf of another individual in financial or legal matters. While a POA can be useful for managing someone's affairs, it can also pose risks if the appointed agent decides to sell the property without the owner's consent.

To prevent unwanted sales via POA, it is essential to take the following steps:

1. "Limit the Scope of Authority": When creating a POA, specify which powers are granted to the agent. Consider limiting their authority to manage only certain assets or transactions.

2. "Choose a Trusted Agent": Select someone you trust implicitly to act as your agent. This could be a family member or a close friend who understands your wishes and values your property.

3. "Regularly Review the POA": Periodically review the terms of your POA to ensure they align with your current wishes and circumstances. Make adjustments as necessary.

4. "Consider a Durable POA": A durable POA remains in effect even if you become incapacitated. This can provide peace of mind that your wishes will be followed in case you are unable to make decisions yourself.

Conclusion

In summary, the choice between a "life estate" and a "Lady Bird deed" depends on your specific needs and preferences in estate planning. Understanding the implications of each option can help you make informed decisions. Additionally, taking proactive measures to prevent the sale of property via "power of attorney" is essential for protecting your assets. By carefully considering these factors, you can ensure that your estate is managed according to your wishes and that your loved ones are properly taken care of in the future.