Understanding "Medicaid estate recovery" in Louisiana is crucial for individuals who are navigating the complexities of long-term care and financial planning. As a state-federal program, Medicaid assists eligible individuals with medical costs, particularly the elderly and disabled. However, many people are unaware that Louisiana has specific regulations regarding the recovery of costs incurred during Medicaid services after the beneficiary's death. This article will provide an overview of the Medicaid estate recovery process in Louisiana, its implications, and important considerations for beneficiaries and their families.

In Louisiana, the "Medicaid estate recovery program" is designed to reimburse the state for the expenses it covered for eligible individuals. This means that after a Medicaid recipient passes away, the state may seek to recover the costs of care provided through the estate of the deceased. This process is governed by federal and state laws and typically applies to individuals aged 55 and older who received long-term care services, such as nursing home care or home and community-based services.

One of the significant aspects of the Medicaid estate recovery in Louisiana is that it only applies to certain types of assets. Generally, the state can pursue recovery from the deceased's probate estate, which includes assets that pass through a will or are subject to the probate process. However, non-probate assets, such as life insurance policies with named beneficiaries, joint bank accounts, and certain retirement accounts, may not be subject to recovery.

Another critical point to understand is that Louisiana has some protections in place to protect surviving family members. For instance, if the deceased individual has a surviving spouse, the state cannot initiate recovery until the spouse passes away. Additionally, if there are surviving children who are under the age of 21 or who are disabled, the estate may also be exempt from recovery efforts during their lifetime.

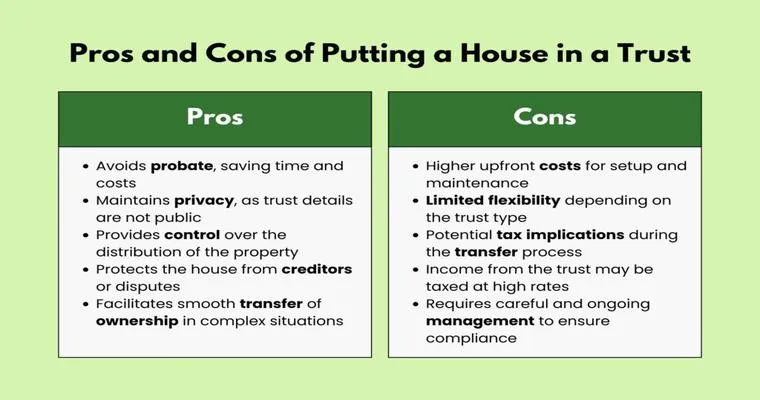

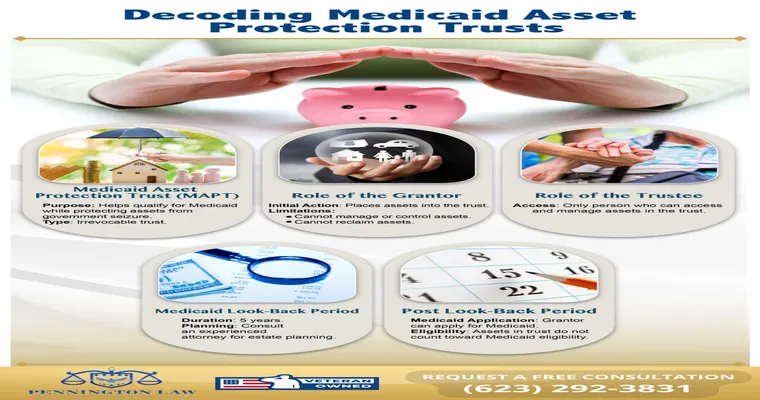

It is essential for individuals planning for long-term care to consider the implications of Medicaid estate recovery. Proper estate planning can help minimize the impact of recovery on heirs and surviving family members. Strategies such as creating a revocable living trust, transferring assets to a spouse, or utilizing certain exemptions can be beneficial. Consulting with an experienced estate planning attorney who understands the intricacies of Medicaid estate recovery in Louisiana is highly recommended.

In conclusion, Medicaid estate recovery in Louisiana is an important consideration for anyone who may rely on Medicaid for long-term care. Understanding the regulations and implications can help individuals and their families make informed decisions regarding their financial futures. By being proactive and seeking professional guidance, it is possible to navigate the complexities of Medicaid estate recovery and protect your assets for future generations.