Understanding "Medicaid in Illinois" can be daunting, especially for those concerned about the potential impact on their "assets". Many individuals and families worry that enrolling in Medicaid could lead to the loss of their hard-earned property and savings. This article aims to clarify the relationship between Medicaid and asset protection, helping you navigate the complexities of this crucial program.

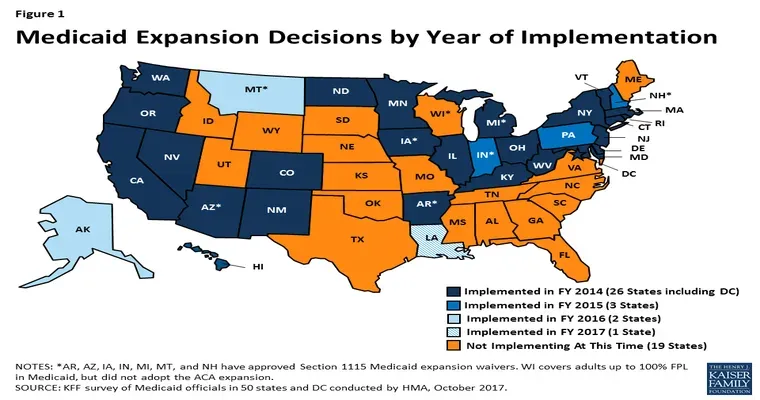

Medicaid is a state and federal program designed to provide health coverage for eligible low-income individuals, including the elderly and those with disabilities. In Illinois, Medicaid can be a vital resource, particularly for seniors needing long-term care. However, the fear of losing assets can deter many from seeking assistance. It is essential to understand how Medicaid assesses assets and what strategies you can employ to protect your wealth.

How Medicaid Determines Asset Eligibility

When applying for Medicaid in Illinois, the state evaluates your financial situation to determine your eligibility. This assessment includes various "countable assets", such as cash, bank accounts, stocks, and bonds. However, not all assets are subject to Medicaid's scrutiny. Certain items are considered "exempt", meaning they won't be counted against you during the eligibility process.

For instance, your primary residence is generally exempt up to a value of $1,033,000 for couples, and personal belongings, such as clothing and household items, are also excluded. Additionally, a car used for transportation is typically not counted as an asset. Understanding these exemptions is crucial for asset protection.

The Look-Back Period

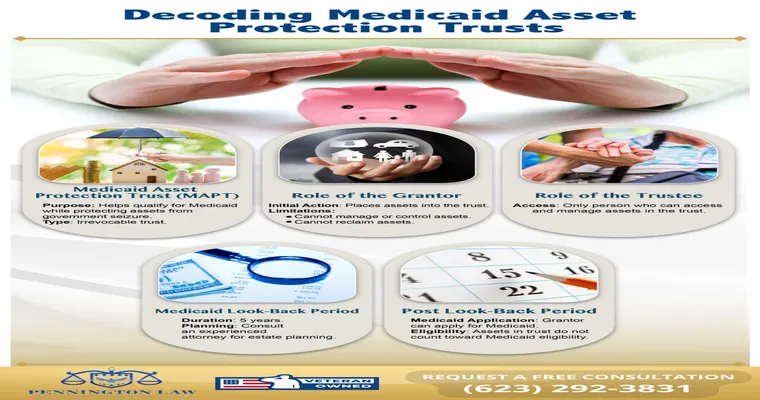

Another critical aspect of Medicaid eligibility in Illinois is the "look-back period". This is a five-year window during which the state reviews any asset transfers you made. If you transferred assets for less than fair market value during this period, you could face a penalty, delaying your Medicaid enrollment. It is important to plan accordingly and avoid any last-minute asset transfers that could jeopardize your eligibility.

Asset Protection Strategies

To ensure you qualify for Medicaid without losing your assets, consider employing several effective strategies:

1. "Consult a Medicaid Planning Attorney": A knowledgeable attorney can provide personalized advice and help you develop a strategy that aligns with your financial goals and Medicaid requirements.

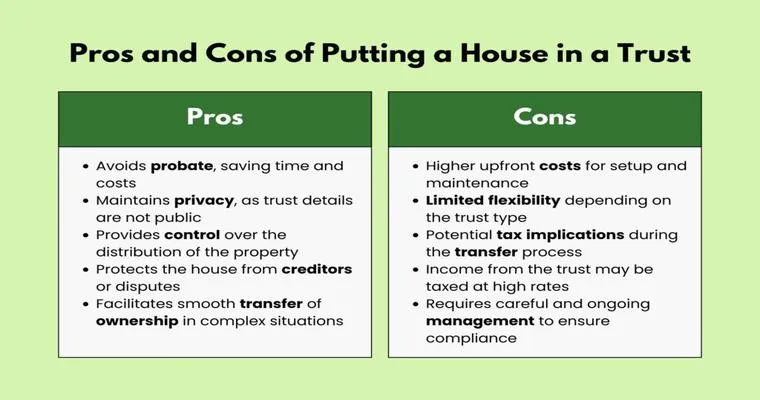

2. "Create an Irrevocable Trust": Placing assets in an irrevocable trust can protect them from being counted when applying for Medicaid. However, it is crucial to set this up well in advance of needing Medicaid services.

3. "Spend Down Strategically": If you have excess assets, you may consider spending down these funds on acceptable expenses, such as medical bills or home modifications that enhance your quality of life.

4. "Purchase Exempt Assets": Investing in exempt assets, such as a primary residence or prepaid funeral plans, can be a smart way to utilize your funds while maintaining eligibility.

Conclusion

Navigating "Medicaid in Illinois" does not have to involve losing your assets. By understanding the eligibility criteria and utilizing effective planning strategies, you can protect your wealth while still accessing the vital healthcare services that Medicaid provides. Whether you choose to consult with a professional or explore asset protection options on your own, being informed is the first step towards securing your financial future. If you have further questions about Medicaid in Illinois, consider reaching out to a qualified expert who can guide you through the process.