Caring for an aging parent is a noble and often challenging responsibility. Many families, like yours, find themselves in a situation where they need to consider options such as a skilled nursing facility (SNF) for their loved ones. If you are wondering whether your mother can qualify for "Medicaid" without having to sell her house, you are not alone. Understanding the eligibility requirements and the potential options available can help you navigate this complex decision while preserving your family's home.

Understanding Medicaid Eligibility

Medicaid is a state and federal program that provides health coverage for low-income individuals, including seniors who require "long-term care". To qualify for Medicaid, your mother's income and assets must fall below certain thresholds. However, there are specific rules regarding how assets, such as a primary residence, are treated.

The Home Exemption Rule

One of the key aspects of Medicaid eligibility is the "home exemption rule". In many states, the primary residence is not counted as an asset when determining eligibility for Medicaid, as long as certain conditions are met. Generally, if your mother intends to return home, the house may be exempt from asset calculations. It is essential to verify the regulations in your state, as these can vary.

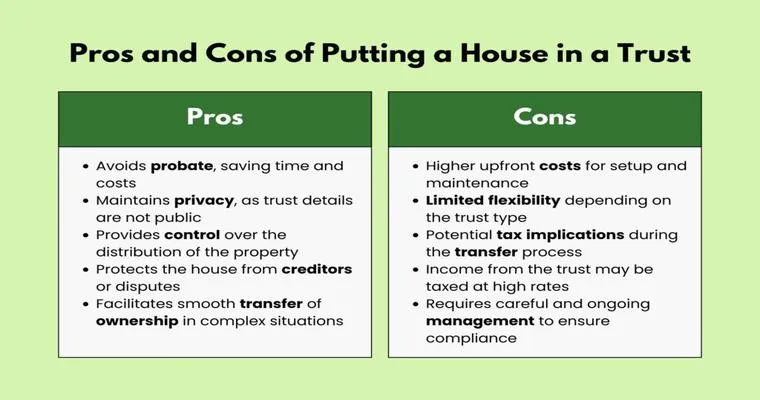

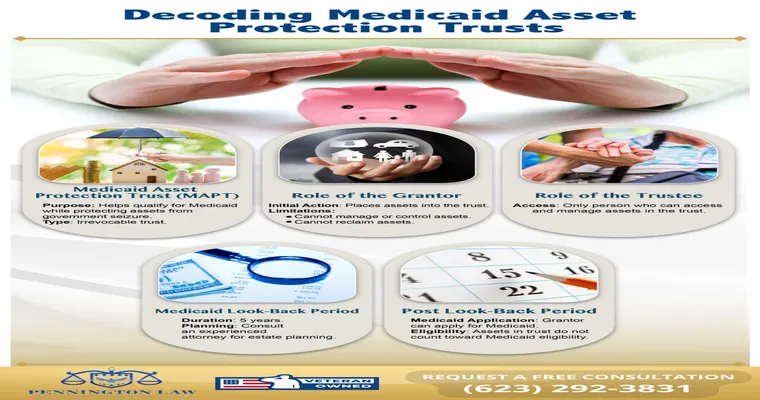

Consider the Look-Back Period

When applying for Medicaid, be aware of the "look-back period", typically five years. During this time, any transfers of assets, including the house, could result in penalties. If your mother has made any significant gifts or sold her home for less than fair market value, this could affect her eligibility. It is crucial to plan ahead and consult with a Medicaid planning professional to avoid any unintended consequences.

Explore Spousal and Caregiver Protections

If your husband and you are the primary caregivers, you may be eligible for certain protections under Medicaid. In some states, there are provisions that allow caregivers to retain the family home and receive compensation for their caregiving services. This can provide financial relief and ensure that you can continue living in the home while your mother receives the care she needs.

Look into Medicaid Waivers

In addition to standard Medicaid benefits, some states offer "Medicaid waivers" that provide additional options for seniors needing long-term care. These waivers may allow your mother to receive care in her home or community settings, which could delay or eliminate the need for a skilled nursing facility. Investigating these programs could offer a more flexible solution to your family's situation.

Seek Professional Guidance

Navigating Medicaid eligibility can be overwhelming, especially when it comes to protecting your mother's assets and ensuring her access to necessary care. It is often beneficial to seek assistance from a qualified elder law attorney or a Medicaid planner. These professionals can help you understand your options, ensure compliance with all regulations, and create a plan that aligns with your family's needs.

Conclusion

Deciding to transition a loved one to a skilled nursing facility is never easy, especially when it involves financial and emotional considerations. However, with careful planning and understanding of the Medicaid system, you may be able to qualify your mother for assistance without selling her house. By taking advantage of the home exemption rule, exploring caregiver protections and Medicaid waivers, and seeking professional guidance, you can make informed decisions that prioritize your mother's well-being while securing your family's future.