Selected reviews about elderly care communities

Selected reviews about elderly care communities offer valuable insights into the experiences of residents and their families. These reviews can highlight the strengths and weaknesses of different communities, helping you make an informed decision when choosing the right care for your loved one.

Should You Convince Your Aging Parents to Move Closer to You?

Deciding whether to persuade aging parents to relocate closer involves weighing emotional, logistical, and financial factors. Consider their independence, health needs, and social connections. Open discussions about support and proximity can help balance their desires with practical considerations, fostering a decision that respects their autonomy while enhancing family bonds.

6 Tips for Long-Distance Caregivers

Supporting a loved one from afar can be challenging. Establish regular communication to stay connected, utilize technology for updates, and coordinate local help when needed. Prioritize self-care to manage stress, stay organized with caregiving tasks, and build a support network to share experiences and resources, ensuring both you and your loved one thrive.

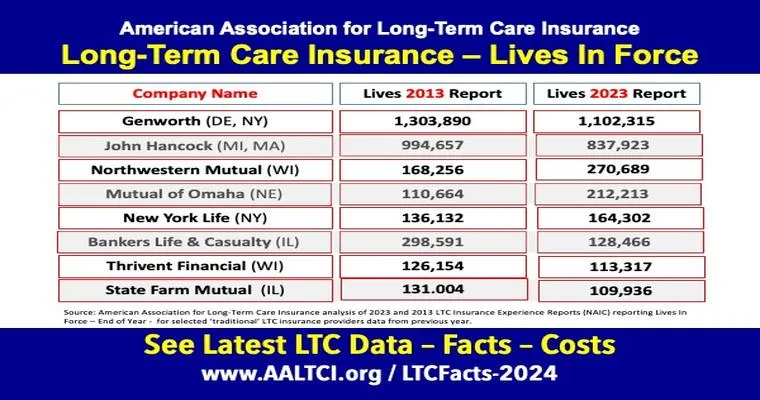

Long-Term Care Insurance Rates on the Rise for Women

Long-term care insurance rates for women are increasing, reflecting their longer life expectancy and higher likelihood of requiring care. This trend poses financial challenges, as women often have less savings and income in retirement. As a result, many may need to reassess their planning for future healthcare needs.

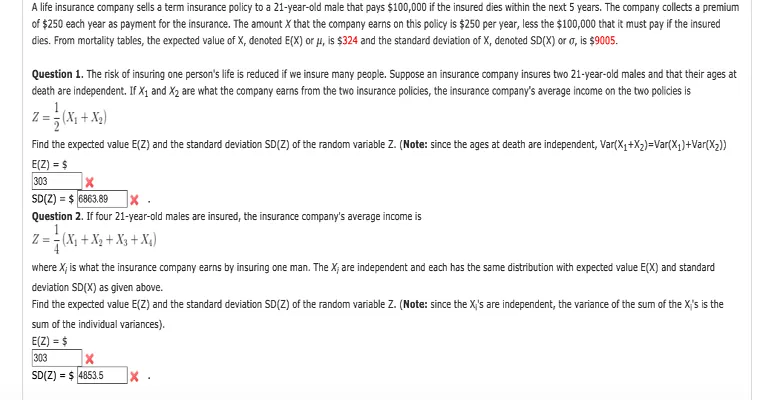

Financial Planning Strategies for Caregivers and Their Parents

Financial planning for caregivers and their parents involves assessing current financial situations, budgeting for healthcare expenses, and exploring insurance options. It’s crucial to create a long-term strategy that addresses potential future needs, fosters open communication among family members, and considers legal documents like power of attorney and wills for effective management.

8 Factors to Consider Before Buying Long-Term Care Insurance

When considering long-term care insurance, evaluate your current health status, potential care needs, premiums, and coverage options. Assess the insurer's reputation and financial stability, understand policy exclusions, and consider inflation protection. Additionally, review the waiting period and benefit duration to ensure the plan aligns with your future needs and budget.

Long-Term Care Insurance: How to Use a Policy and File a Claim

Long-term care insurance provides financial support for individuals requiring extended care due to chronic illnesses or disabilities. To use a policy, familiarize yourself with coverage details and eligibility requirements. When filing a claim, gather necessary documentation, such as medical records, and submit the claim to the insurance provider for review and approval.

I know there aren't as many options for good Long Term Health care Insurance anymore. What are the good options left?

Long-term health care insurance options have become limited, making it essential to explore the best remaining choices. Some viable alternatives include hybrid policies that combine life insurance and long-term care benefits, as well as traditional long-term care insurance with customizable plans. It's important to assess individual needs and budget when selecting coverage.

Looking for long-term care and diagnosis solutions for my 65-year-old mother following rapid mental decline.

Seeking comprehensive long-term care and diagnostic solutions for my 65-year-old mother who has experienced a rapid decline in mental health. Her condition requires urgent attention to ensure she receives appropriate support, assessment, and treatment options tailored to her needs for improved quality of life and well-being.

I took out long term care insurance policy 30 years ago at $1,500 per year. The price keeps rising and now it is $19,200 per year. What do I do?

After purchasing a long-term care insurance policy for $1,500 annually three decades ago, you now face a steep increase to $19,200 per year. Consider evaluating your current financial situation, exploring options to reduce coverage, or consulting a financial advisor for alternatives that better fit your budget and care needs.

In-home care vs long term care facility?

In-home care allows individuals to receive support and assistance within the comfort of their own homes, promoting independence and familiarity. In contrast, long-term care facilities provide structured environments with comprehensive services for those needing more intensive medical or personal care, often fostering social interactions among residents.

Mom's MC roommate died, and she went from hating having a roommate to hating being alone in the room. Do I need to change anything?

After her roommate's unexpected death, Mom experienced a profound shift in her feelings. Once frustrated by the constant presence of another person, she now found the silence of the empty room suffocating. The absence of companionship transformed her loneliness into a heavy burden, leaving her to grapple with unexpected grief.

Sometimes I feel like I can handle all this, but the hardest part is the loneliness of not feeling I can vent without judgement.

The struggle of managing overwhelming emotions often feels bearable, yet the weight of loneliness can be suffocating. The inability to express thoughts and feelings without fear of judgment creates a barrier, making it difficult to seek support and connection, ultimately intensifying the sense of isolation in challenging times.

Activities for someone with Macular Degeneration and first stage dementia?

Engaging individuals with macular degeneration and early-stage dementia can include activities like sensory gardening, where they can touch and smell plants, and simple cooking tasks that involve familiar ingredients. Memory games using textured cards or storytelling sessions can also stimulate cognitive function while fostering connection and enjoyment. Social interactions are beneficial too.

Update on mom

Mom has been feeling better lately, showing signs of recovery and increased energy. She's been enjoying her favorite activities and engaging more with family. The doctor is pleased with her progress, and we remain optimistic about her continued healing. Support from loved ones has made a significant difference in her spirits.

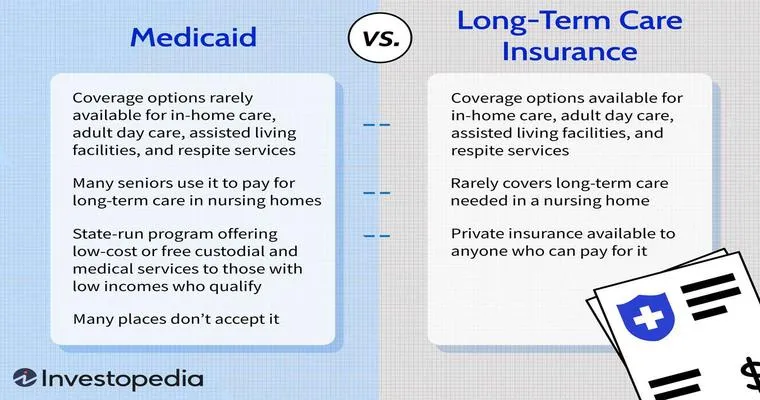

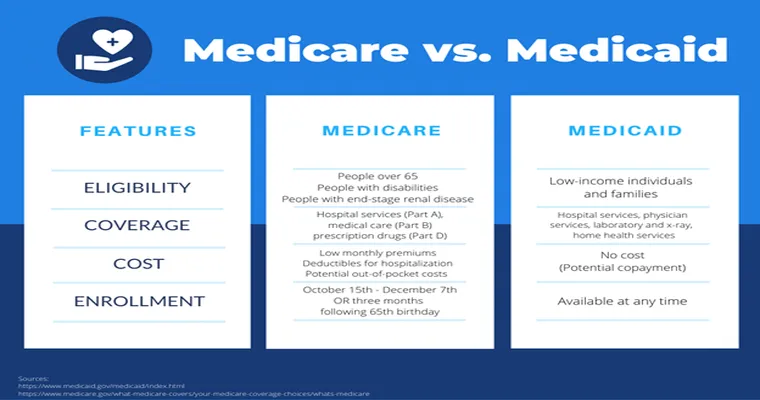

Does Medicaid pay for the remainder of balance after your monthly checks?

Medicaid typically covers healthcare costs for eligible individuals, but it does not pay for the remainder of a balance related to monthly checks or personal expenses. Instead, it focuses on medical services, long-term care, and specific treatments, helping to alleviate healthcare costs rather than supplementing income or personal finances.

Can spouse sell home if wife is on New York State Medicaid?

In New York State, if a spouse is on Medicaid, the other spouse can sell the home, but there are important considerations. Proceeds from the sale may affect Medicaid eligibility and benefits. It's crucial to consult with a legal or financial advisor to understand potential implications and ensure compliance with Medicaid rules.

Can NYS medicaid long-term nursing care in a nursing home be transferred to medicaid for home care?

New York State Medicaid allows for a transfer from long-term nursing care to home care services. However, eligibility requirements must be met, including functional needs assessments and financial criteria. It is essential to consult with Medicaid representatives to understand the specific processes and conditions for such transitions.

I am a caseworker on Maui.

As a caseworker on Maui, I support individuals and families in navigating social services and resources. My role involves assessing needs, providing guidance, and advocating for clients to ensure they receive essential assistance. I am deeply committed to fostering resilience and empowerment within the diverse communities I serve on the island.

Anxiety about visits.

Anxiety about visits often stems from concerns over social interactions, fear of judgment, or feelings of inadequacy. Anticipating gatherings can lead to restlessness and overthinking, making it difficult to enjoy the experience. This unease may manifest physically, impacting overall well-being and causing individuals to avoid social situations altogether.

Medicaid or Medicare: Who Pays for Nursing Home Fees?

Medicaid typically covers nursing home fees for eligible individuals with limited income and assets, providing essential support for long-term care. In contrast, Medicare offers short-term coverage for skilled nursing care but does not pay for long-term stays. Understanding these programs is crucial for families planning for nursing home expenses.

Page 47 of 134