Selected reviews about elderly care communities

Selected reviews about elderly care communities offer valuable insights into the experiences of residents and their families. These reviews can highlight the strengths and weaknesses of different communities, helping you make an informed decision when choosing the right care for your loved one.

What to do with mom's pending personal injury settlement if she is in a nursing home and on Medicaid and Medicare?

If your mother is in a nursing home and receiving Medicaid and Medicare, it's essential to consult with a legal expert about her pending personal injury settlement. The settlement may affect her eligibility for benefits, so proper management, including potential spend-down strategies, is crucial to protect her financial interests and healthcare coverage.

I am running out of ideas as I spend down my mother’s condo profits so she stays medicaid eligible. Ideas?

Facing the challenge of managing your mother’s condo profits while ensuring her Medicaid eligibility can be daunting. Consider investing in small home improvements, creating a dedicated emergency fund for medical expenses, or exploring community-based services that enhance her quality of life without jeopardizing her financial status.

How can we protect the proceeds of a veteran's home sale, so he won't lose his VA pension?

To protect a veteran's home sale proceeds and preserve their VA pension, it is essential to consult a financial advisor familiar with VA regulations. Options include establishing a special needs trust, investing in exempt assets, or spending funds on qualified expenses, ensuring compliance with income limits while safeguarding benefits.

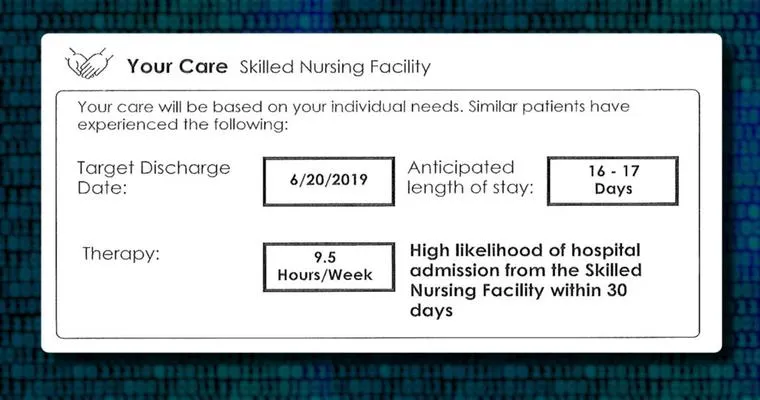

MIL in skilled nursing under Medicaid. Can’t make house payments.

Medicaid covers Medical Institutional Leave (MIL) for residents in skilled nursing facilities, allowing them to retain their benefits while temporarily leaving for medical reasons. However, financial challenges may arise, particularly if individuals struggle to make house payments during their stay, complicating their ability to maintain their homes.

How Involved Should Families Be When Elders Live in a Senior Living Facility?

Families should maintain regular communication and visits with their elders in senior living facilities to provide emotional support and companionship. Involvement should balance respect for the elder's independence with active participation in care decisions, ensuring their needs and preferences are prioritized while fostering a sense of connection and belonging.

How to Talk to Aging Parents About Moving Into Assisted Living

Approach the conversation with empathy and understanding, focusing on your parents' needs and feelings. Discuss the benefits of assisted living, such as safety and social engagement. Listen actively to their concerns, and involve them in the decision-making process, ensuring they feel respected and supported throughout the transition.

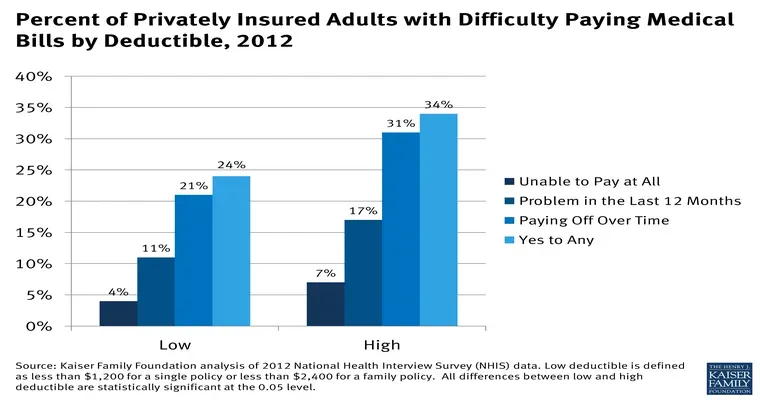

Methods of Payment and Financing Options for Assisted Living

Assisted living facilities offer various payment methods, including private pay, long-term care insurance, and veterans' benefits. Financing options may include personal savings, reverse mortgages, and loans specifically designed for senior care. Understanding these alternatives helps families manage costs while ensuring quality care for their loved ones.

What To Do When Elderly Parents Refuse Assisted Living

When elderly parents resist assisted living, approach the situation with empathy and open communication. Discuss their concerns and preferences, explore alternative support options, and involve them in decision-making. Consider gradual adjustments, such as in-home care or community resources, to ease the transition and ensure their safety and well-being.

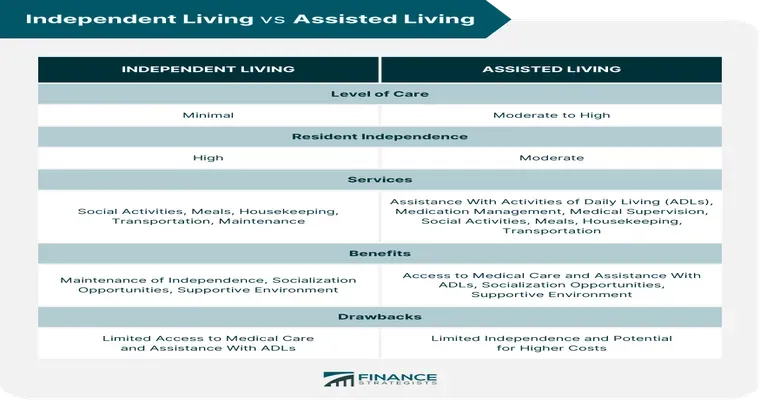

Independent Living vs. Assisted Living: Everything You Need to Know

Independent living offers seniors the freedom to maintain their lifestyle in a community setting, providing social activities and amenities. In contrast, assisted living provides additional support with daily tasks, such as bathing and medication management, ensuring residents receive the necessary care while still enjoying a degree of independence.

Choosing a Long-Term Care Facility: Tips from a Certified Nursing Assistant

Selecting a long-term care facility involves assessing the quality of care, staff qualifications, and facility cleanliness. Visit potential locations, ask about activities and services, and consider family involvement. Prioritize communication with staff to ensure a supportive environment that meets the needs of residents and their families.

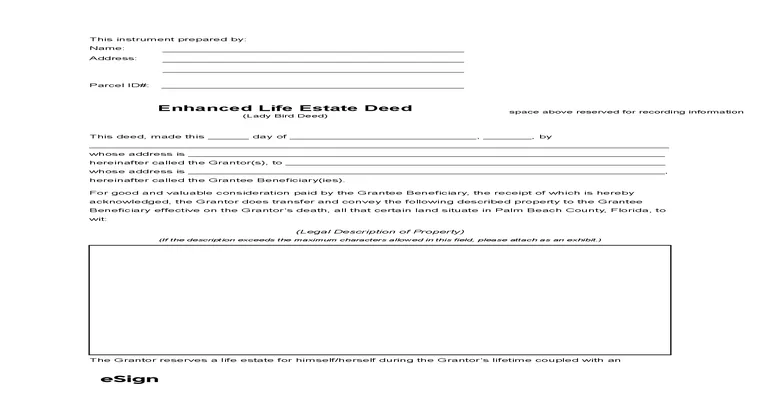

Life estate vs lady bird deed and preventing sale via POA. Suggestions?

A life estate allows individuals to use property during their lifetime, with ownership passing to a designated beneficiary afterward. A Lady Bird deed enables property transfer upon death without probate, retaining control during life. Both can complicate property sale if a power of attorney is involved, requiring careful planning.

My husband passed away on January 17 and has a debt with the nursing home of $22,000. What should I do?

Losing a spouse is incredibly challenging, especially with outstanding debts. First, review his financial documents to understand the debt obligations. Contact the nursing home to discuss payment options. Consider consulting a financial advisor or an attorney to navigate the situation and explore potential legal protections. Take care of yourself during this difficult time.

My husband and I live with my mother as her full-time caregivers, but it is time for a SNF. Is there any way she can qualify for Medicaid without having to sell the house (we plan to continue living in it)?

My husband and I are full-time caregivers for my mother, but we believe it's time for her to move to a skilled nursing facility. We’re exploring options for her to qualify for Medicaid without selling her house, as we intend to continue living there after her transition.

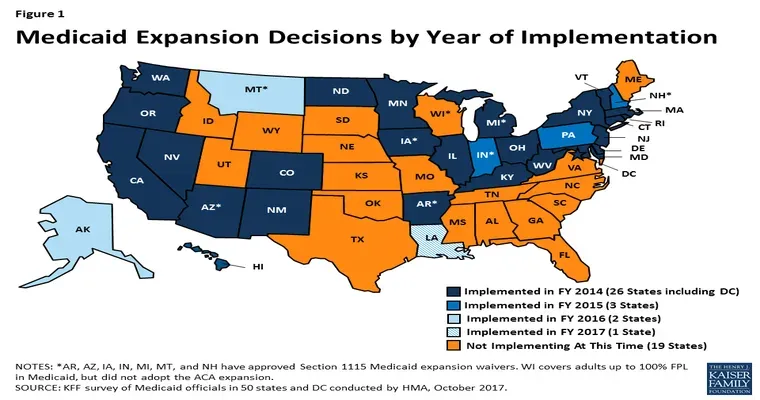

Medicaid in Illinois: Will the state take both our assets?

Medicaid in Illinois provides health coverage for low-income individuals, but asset rules can be complex. Generally, the state does not take all assets, but certain resources may be counted when determining eligibility. Strategic planning is essential to protect crucial assets while accessing Medicaid benefits for long-term care needs.

What can my sister and I do to keep the government from stepping in and taking my parents home if they go to a nursing home?

To protect your parents' home, consider establishing a revocable living trust, which allows them to retain ownership while qualifying for assistance. Additionally, explore options like Medicaid planning, gifting strategies, and ensuring that assets are structured to avoid depletion. Consulting with an elder law attorney can provide tailored guidance for your situation.

If a spouse lives in the home, can Medicaid put a lien on it to collect when the other spouse, who was in a memory care facility, passes?

Medicaid may place a lien on a couple's home to recover costs after one spouse in a memory care facility passes away. However, if the other spouse continues to live in the home, certain protections may apply, allowing them to remain without immediate financial burden from Medicaid's claims.

The Appalachian elders, what will become of them?

The Appalachian elders embody rich traditions and wisdom rooted in their mountainous culture. As younger generations migrate for opportunities, their knowledge and lifestyles face potential fading. Preserving their stories and practices is crucial to maintaining cultural heritage, ensuring that the legacy of these resilient communities endures despite modern challenges.

ALF.

ALF is a beloved 1980s sitcom featuring a wisecracking alien from the planet Melmac who crash-lands on Earth. He becomes part of the Tanner family, creating humorous chaos as he tries to adapt to human life while hiding from government authorities. The show blends comedy with themes of family and friendship.

Laugh for the day!

Laugh for the Day! is a delightful daily dose of humor designed to brighten your mood and lighten your spirit. Each installment features a carefully curated selection of jokes, funny anecdotes, and witty observations that encourage laughter and joy. Perfect for sharing with friends or enjoying alone, it’s a simple way to uplift your day.

VA nursing homes.

VA nursing homes provide specialized care for veterans, offering a supportive environment tailored to their unique needs. These facilities focus on promoting physical and mental well-being, delivering comprehensive medical services, rehabilitation, and social activities. The aim is to enhance quality of life while honoring the sacrifices made by those who served.

Page 122 of 134